Bank of Canada interest rate hike

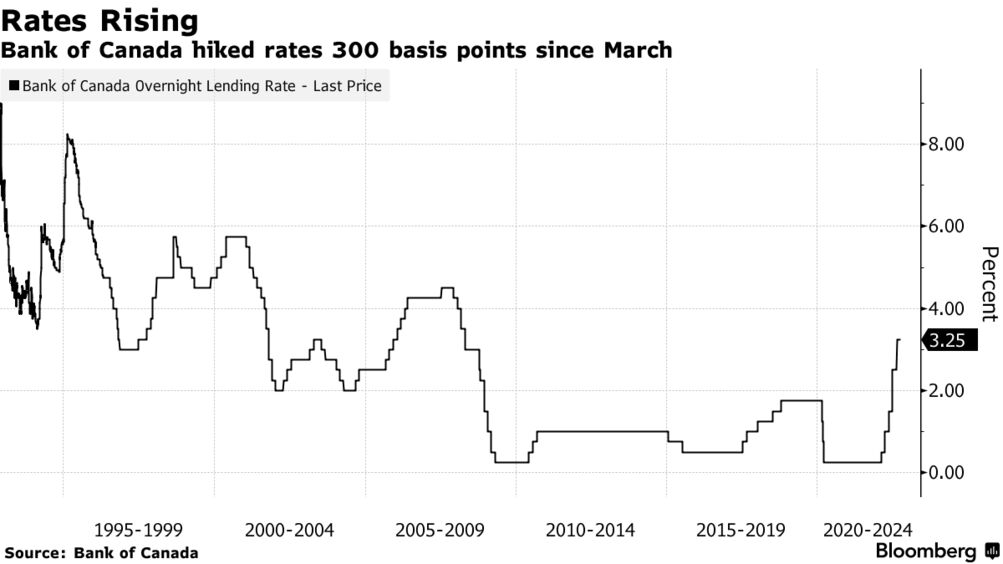

The Bank of Canada raised its overnight rate by 75 basis points moving its policy rate to 325 per cent from 25 per cent. 7 could even be a full percentage point.

Bank Of Canada Not Done On Rate Hikes Cibc S Tal Canadian Mortgage Professional

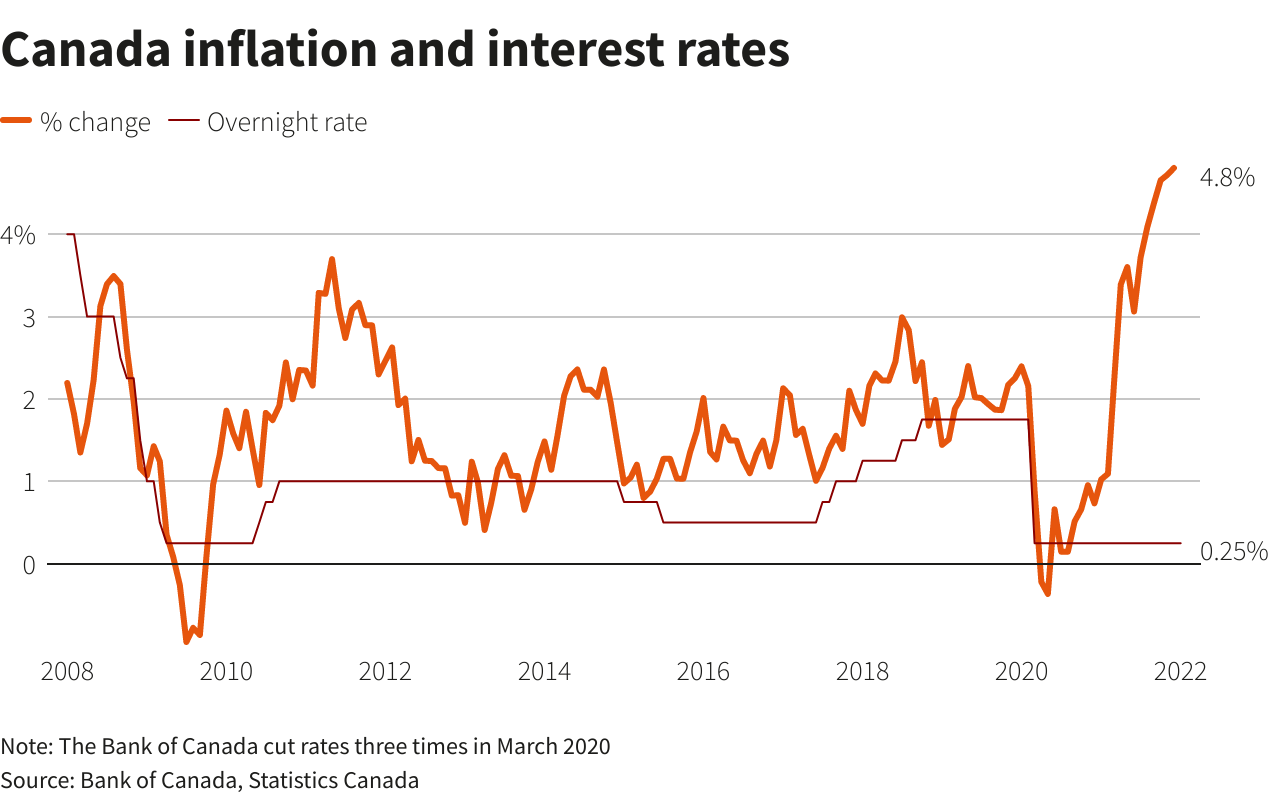

Also policymakers said interest rates will need to rise further given the outlook for inflation with surveys suggesting that short-term inflation expectations remain high.

:format(webp)/https://www.thestar.com/content/dam/thestar/politics/federal/2022/10/23/jagmeet-singh-says-there-is-no-merit-to-expected-bank-of-canada-interest-rate-hike/jagmeet_singh.jpg)

. 7 could even be a full percentage point. The Canadian economy is much more interest rate sensitive than historically due to elevated household debt and overvalued housing. Central bank did a lot more than raise its policy interest rate by another three-quarters of a percentage point to a range of 3 per cent to 325 per cent a 14-year high.

Canada Tops G7 With Another Interest Rate Hike of 075. A history of the key interest rate Over the years the Bank of Canada has adjusted the way it sets its key interest rate. Bank of Canada delivers 075 percentage point rate hike.

The Bank of Canada raised the overnight rate to 325 and stated that it will continue with Quantitative Tightening QT. Bank of Canada delivers a 75 basis-point rate hike. The Bank is also continuing its policy of quantitative tightening.

Interest rate announcement and Monetary Policy Report. The global and Canadian economies are evolving broadly in line with the Banks July projection. 1 day agoEven as warnings about a potential recession grow louder the Bank of Canada is expected to announce another hefty interest rate hike on Wednesday edging the bank closer to the end of one of the.

Canada now has the highest policy interest rate among the G7 countries after the Bank of Canada announced another interest rate hike of 075 on September 7 2022 bringing. At the heart of the Bank of Canadas monetary policy is the target for the overnight rate. The Fed raised the federal funds rate by 75 bps to the 3-325 range during its September meeting the third straight three-quarter point increase pushing borrowing costs to the highest since 2008.

The Investment Industry Regulatory Organization of Canada will start publishing for informational purposes only the 1- and 3-month transaction based BA rates on the same date. The surprise 100bps rate hike in July brought the overnight rate to 25 the middle of the BoCs 2-3 neutral range estimate but well into restrictive territory in our view. The Central Bank of Sweden Sveriges Riksbank announced a 100 basis points hike in interest rates saying that the inflation was too highThe announcement came on Tuesday morning taking the regulators primary policy rate to 17 per cent.

Economists are expecting the Bank of Canada to continue its aggressive rate hike campaign after inflation data came in higher than expected. His message that the US. The Bank of Canada today increased its target for the overnight rate to 3¼ with the Bank Rate at 3½ and the deposit rate at 3¼.

The Bank of Canada raised the target for its overnight rate by 75bps to 325 in September 2022 in line with market forecasts. Interest Rate in the United States averaged 543 percent from 1971 until 2022 reaching an all time high of 20 percent in March of 1980 and a. Among Canadas major banks Royal Bank of Canada and Toronto-Dominion Bank now expect Canadas interest rate to peak at 4 per cent and Canadian Imperial Bank of Commerce has raised its forecast to 375 per cent.

2 days agoThe Bank of Canada has already increased the policy rate by three percentage points over the course of the year bringing the overnight rate to 325 per cent. The Bank of Canada today increased its target for the overnight rate to 1 with the Bank Rate at 1¼ and the deposit rate at 1. With respect to ongoing high inflation it stated that data indicate a further broadening of price pressures particularly in services.

The Bank of Canada hiked its trendsetting interest rate by three-quarters of a percentage point on Wednesday the latest move by the central bank in its mission to rein in runaway inflation. The Bank is also ending reinvestment and will begin quantitative tightening QT effective April 25. It is the fifth consecutive rate hike pushing borrowing costs to the highest since 2008.

The effective interest rate for households is a weighted-average of various mortgage and consumer credit interest rates. Maturing Government of Canada bonds on the Banks balance sheet will no longer be replaced and as a result. The Bank of Nova Scotia and Bank of Montreal also predict a 375 per cent peak.

Since March the bank has increased its policy rate by 300 basis points. If the Bank of Canada opts to only raise interest rates by half a percentage point to three per cent the same homeowner would still be paying 156 more per month or 1872 more a year. The Bank of Canada raised its overnight interest rate by 75 basis points to 325 per cent on Wednesday its fifth consecutive hike in its.

In a report published last week economists Benjamin Tal and Karyne Charbonneau say they expect the Bank of Canada to hike another 75 bps next week and will then call it a day leaving the overnight target rate at 325 for the duration of 2023. His message that the US. The Bank of Canada delivered a fourth consecutive outsized interest-rate hike in a bid to slow the nations economy and drag inflation down from four-decade highs.

On Wednesday the US. The warning comes just weeks after the Bank hiked interest rates by 05. The bank justified the hike by noting that the average household was losing its purchasing power making it difficult for.

Bank of Canada Governor Tiff Macklem raised the banks benchmark interest rate by a full percentage point to 25 per cent the largest one-time increase since 1998 to combat high inflation. See what it isand what it means for you. But speaking on Saturday he said officials would not hesitate to raise interest rates to meet the inflation target of 2.

If CIBC economists are correct the Bank of Canadas expected rate hike next week will be its last of this rate-hike cycle. Central bank will stay aggressive on interest rates had some observers speculating that the Bank of Canada hike on Sept. Central bank will stay aggressive on interest rates had some observers speculating that the Bank of Canada hike on Sept.

Economists tracked by Bloomberg were expecting a 67 per cent increase. The team at Desjardins expects Bank of Canada governor Tiff Macklems tough talk on inflation would push him to hike rates by another 75 basis points bringing it to four per cent. The latest data released by Statistics Canada on Wednesday shows the consumer price index CPI up 69 per cent year-over-year in September.

Bank Of Canada Hikes Key Interest Rate To 0 5

Bank Of Canada Interest Rate 1935 2022 2022 Forecast Wowa Ca

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting Trade Tensions Cbc News

Investors Expect Bank Of Canada Shift To Half Percentage Point Rate Hikes Reuters

Bank Of Canada Expected To Raise Interest Rates On Wednesday As Recession Fears Grow Investment Executive

Scotiabank On Twitter The Bank Of Canada Is Expected To Raise Interest Rates March 2 What Does That Really Mean For Your Day To Day Life Learn More About Rate Hikes And How They

Bank Of Canada Could Raise Interest Rates By 75 Basis Points Economists The Deep Dive

Bank Of Canada Interest Rate Decision What You Need To Know Financial Post

Bank Of Canada Raises Interest Rate To 1 75 Cbc News

Interest Rates How High Is Too High Morningstar

Bank Of Canada Raises Key Interest Rate But Inflation Could Prove Difficult To Tame National Globalnews Ca

Bank Of Canada Expected To Announce Oversized Rate Hike This Week The Globe And Mail

Bank Of Canada Hikes Benchmark Interest Rate To 1 Cbc News

Bank Of Canada Makes Another Emergency Cut To Interest Rate Cbc News

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged Reuters

Bank Of Canada Hikes Key Interest Rate Sam Obeid Toronto Realtor